Every generation has its asset class, could Bitcoin be the one for the current age?

When Julio Rodriguez was a young boy, he remembers fondly the Sunday dinners that his mother would prepare.

Coming back from soccer practice on a Sunday afternoon, Rodriguez would be greeted with the familiar aroma of his mother’s asado.

The son of a college professor, Rodriguez remembers growing up fairly well off, and what most would consider, decidedly middle class.

But by the mid-1970s, Rodriguez, who was just starting elementary school started noticing that things in his family were changing.

Instead of the prime cuts of asado that his mother would prepare on Sunday evenings, off cuts were used.

Instead of a bottle of wine, his parents would now share a small carafe.

And while Rodgriguez was still too young to know better, all around him, the once plentiful Argentine economy was being brought to its knees under the combined weight of excessive government spending, large wage increases and gross inefficiencies.

By the 1980s, Argentine debt had risen to over three-fifths of production.

And attempts by Buenos Aires to rein in inflation by artificially pegging the peso to equal the value of the dollar, not only failed but caused inflation to briefly cross 1,000% annually.

Successive regimes tried to control inflation through wage and price controls, cuts in public spending and restricting the money supply.

But those measures came to naught when in 1982, in an effort to distract a frustrated public, Argentina waged an expensive and ultimately ill-conceived war with the United Kingdom over the Falkland Islands.

And as millions of Argentinians, in particular those with fixed incomes, like Rodriguez’s father, saw the real value of their incomes plummet, the asset that many turned to was gold.

The question now as central bankers, in particular the U.S. Federal Reserve, demonstrate that they are willing to tolerate ever-increasing levels of inflation, is whether or not investors should be looking for inflation hedges.

Wither Wander the Dollar?

Over time, the dollar closely tracks an inverse relationship with U.S. inflation expectations and stems from the fact that a weaker dollar is inherently inflationary, because it undermines the purchasing power of U.S. consumers, investors and debt holders.

Monetary and fiscal policies geared towards a weaker greenback could greatly aid in reducing debt burdens through this inflationary effect — because a dollar borrowed by the U.S. government today is worth far less when Washington eventually (if ever) pays you back if inflation is high.

Fiscal stimulus also tends to weaken a currency’s medium-term outlook.

And with the Biden administration gunning for a fresh US$2.2 trillion stimulus package after just clearing its US$1.9 trillion one, the White House is demonstrating an appetite to keep writing checks regardless if the U.S. Federal Reserve can ever cash them.

The prospect of more U.S. deficit spending to combat the economic effects of the pandemic, and fund other domestic priorities (because if you’re going to borrow money, you might as well ask for as much as you can) such as infrastructure, will keep the medium-term outlook for the dollar muted, and is potentially supportive of assets such as gold and Bitcoin.

But Bullion or Bitcoin?

Absent alternatives to gold, one would expect that given concerns over inflation, gold should be rising, but it hasn’t.

Despite widespread belief in a new wave of reflationary economic growth and a historic amount of money-printing, which is normally inflationary, gold has underperformed.

Why is that?

Demand for gold can be attributed to its perception as an asset against fiat currency debasement — if people are worried about the long-term buying power of government-issued currencies, they will be prepared to pay more for gold, which is viewed as a store of value.

But the past year has seen the rise of a viable alternative to gold — Bitcoin.

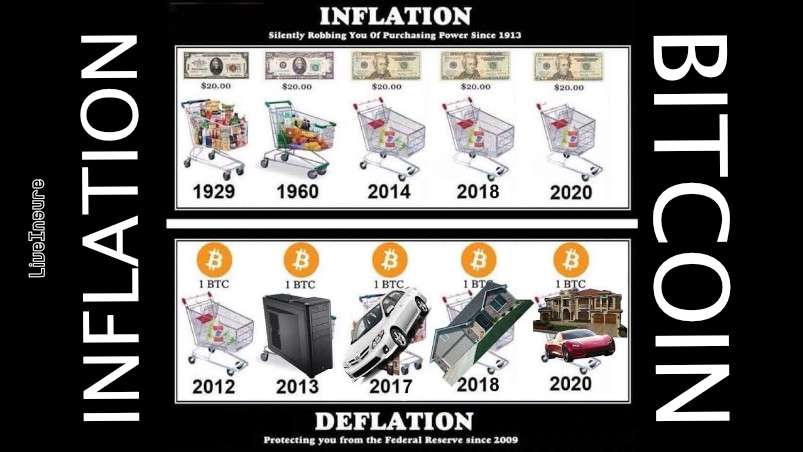

As Bitcoin has risen in investors’ consciousness, so has the growing chorus of voices which tout its ability to act as a check against fiat currency debasement.

And the election of the U.S. President Joe Biden has only helped to increase Bitcoin’s popularity.

Driven by a fear of hard swing to the left, more investors are betting on Bitcoin in anticipation that a free spending Democrat-led government in the U.S. will engender systemic profligacy that has the potential to damage the long term value of the dollar.

But beyond the anecdotal, there is circumstantial evidence that some of the money that would otherwise have headed into gold has gone into Bitcoin.

Since last May, a steady outflow of funds from gold and gold-based ETFs (exchange traded funds), coincided with larger flows into Bitcoin.

And while not all the money leaving gold has gone into Bitcoin, a significant chunk of change has.

Institutional investors, in particular family offices, are making a decision to allocate at least some money to Bitcoin as a hedge against a fiat collapse.

Because while you may hope to never have to use a doomsday shelter, you’re glad you built it if the zombie apocalypse ever comes.

And Bitcoin’s performance over the past year has also demonstrated a close alignment with bond yields — something that gold used to do until fairly recently.

When bond yields rise, so has Bitcoin — implying that the bellwether cryptocurrency directly benefits from the so-called “reflation trade” — the belief that inflation is just around the corner.

The same ought to be true of gold — gaining when fears over inflation rise, and slipping when such fears subside.

Yet the opposite seems to be happening.

While Bitcoin has been positively correlated with inflation fears, gold appears to be negatively correlated, with the current drive in Bitcoin looking very much like a bid to protect against currency debasement, by means of a measured transfer from gold.

Bitcoin’s most recent pause, also seemed to have coincided with the pause in the bond market.

Although the benchmark 10-year U.S. Treasury yield spiked in late February, it has since stabilized, essentially moving sideways — much like Bitcoin’s movement just below US$60,000.

So could Bitcoin be the “precious” that miners should really be working on instead of the shiny stuff?

Definitely Maybe

Gold at least has an intrinsic use as the raw material for jewelry.

Bitcoin’s value lies in its ability to create a parallel system of value that could potentially one day supersede established regimes.

But as history has shown, incumbents generally do not take well to having their regimes challenged.

That central banks are now in a race to issue their own digital currencies should be revealing — it’s common to first deride that which is feared, before co-opting it’s best parts.

But central bank-issued digital currencies are missing the point behind Bitcoin’s promise— certainty and the finality of value.

Bitcoin was ingeniously designed so that the supply of new Bitcoin will reduce over time — it is by design deflationary, but that will also reduce the incentive to spend Bitcoin, something which could see its value ironically increase.

Monetary inflation, which is closely linked to fiat currency debasement, translates to rising financial asset valuations.

Both factors work in Bitcoin’s favor.

As investors hold on to more Bitcoin in anticipation of its price rising, monetary inflation, which chases up the price of fewer assets, works in Bitcoin’s favor.

To date, the U.S. Federal Reserve, the Bank of England, the European Central Bank and the Bank of Japan, have all increased their holdings of debt to nearly US$24 trillion, amounting to 55% of the aggregate GDP of their economies.

This stimulus by the world’s four most significant central banks has created an inordinate amount of liquidity in global capital markets, pushing up the valuation of everything from stocks to cryptocurrencies.

As long as central banks continue their strategy of adding liquidity (and because of the amount of debt they have created, they have little alternative), investors can expect more volatility with risk asset valuations and fiat currency debasement, factors that are likely to play up well to Bitcoin’s narrative.

But perhaps whereBitcoin really shines is that it isn’t strongly correlated with any other asset, inflation or not.

Bitcoin’s consistently lower correlation reinforces its stronger diversification potential during a range of business cycles, providing efficient diversification to hedge portfolio inflation risk, while providing ample upside potential.